All Australian OEM new-car importers and retailers should read this – and take action.

Pitcher Partners is an independent Australian accounting and business advisory.

The firm recently published its assessment of Australia’s new car market for 2024 and beyond in a report titled “Moving from sunset to sunrise: What are the top 10 automotive challenges for FY24?”.

It’s an eye-opening read, especially if you’re a new-car importer or retailer in Australia.

You can find the article here.

Author Steve Bragg asserts the major course changes facing the car industry were set decades ago.

He says the industry entered this ‘sunset’ phase it currently finds itself in way back in the 1970s.

His article’s critical points focus on the challenges automotive retailers (and, to a different extent, OEM carmakers and importers) need to overcome to join the emerging ‘sunrise’ phase that’s coming.

Two key points stand out among his list of 10 challenges: they are EV (electric vehicles) and partnering.

The move to cleaner propulsion systems in new cars is well advanced. Global carmakers are investing tens of billions of dollars into battery-electric drive systems and other zero-emissions technologies.

Besides addressing tailpipe outputs, Bragg says their effects will determine the future viability of automotive retailers.

He says “that at a 75 / 25 ICE to EV ratio dealers can maintain profitability.

“At 50/50 its breakeven, at 25/75 you are printing losses.”

That’s eye-opening. Internal combustion engines (ICE) that use petrol and diesel fuels currently power almost all of Australia’s current-day car parc of around 20 million registered vehicles.

Battery electric vehicle (BEV) sales might have been ‘only’ 7.2% of Australia’s new-car sales last year but they’re growing, and quickly.

The other major point Bragg makes relates to partnering.

It’s a concept not often used in Australia’s auto sector.

He recommends automotive dealers consider tie-ups with major retailers from other industries.

He suggests this because, for Australia’s new-car retailers, “The large organisations will prevail and dominate the industry,” adding that “survival will be for the biggest and the most adaptable.”

Moving from sunset to sunrise paints a troubling image for the future of Australia’s automotive retailing industry.

Reading it might cause worry.

What it should spark, however, is action.

The report’s target audience is Australia’s networks of official new-car retailers, but it raises opportunities for the official OEM importers that supply the cars they sell.

The biggest of these relates to partnering.

Working with the right partners to satisfy existing and future buyers has become an important part of many automakers’ go-to-market plans.

We know this because it’s what we do for a number of big brands.

They’ve all investigated these simple but critical questions: Who are our customers? What products are we selling? And what specific problems do they solve for these people?

Most of these answers are functional in nature. But the more important ones are emotional.

Many new-car buyers fulfill these feelings in the aftermarket by buying suspension upgrades, accessories and styling changes.

They do this because they want something specific in their new car, something their chosen brand’s new-model catalogue doesn’t offer: a car that suits Australia’s conditions and their own tastes.

It’s why carmakers use us for local-market new-car enhancement programs.

Many official new-car importers are getting less say in their future product planning choices.

And many of these future models they’ll be tasked with selling might not perfectly meet local buyer tastes. At least not yet.

But these cars need to keep funding the vast cost in transitioning to zero-emissions vehicles.

Localising some of the new-car models these brands currently offer helps maximise their sales opportunities and revenue growth.

It also means Australian buyers get the new cars they really want: that is, vehicles with built-for-Australia enhancements (such as locally engineered and fully integrated suspension upgrades) and cars that have the styling they’re after (achieved with local design enhancements). And they’re all delivered neatly with the comfort of a new-car warranty.

These customers are often prepared to pay a little more to get the car they really want.

There are plenty of these buyers. And they’re waiting for the right car from their favourite brands.

So, if you’re an OEM new-car importer, don’t wait.

Enhance the product line-up you’ve got now.

Bernie Quinn – Engineering Director, Premcar Pty Ltd

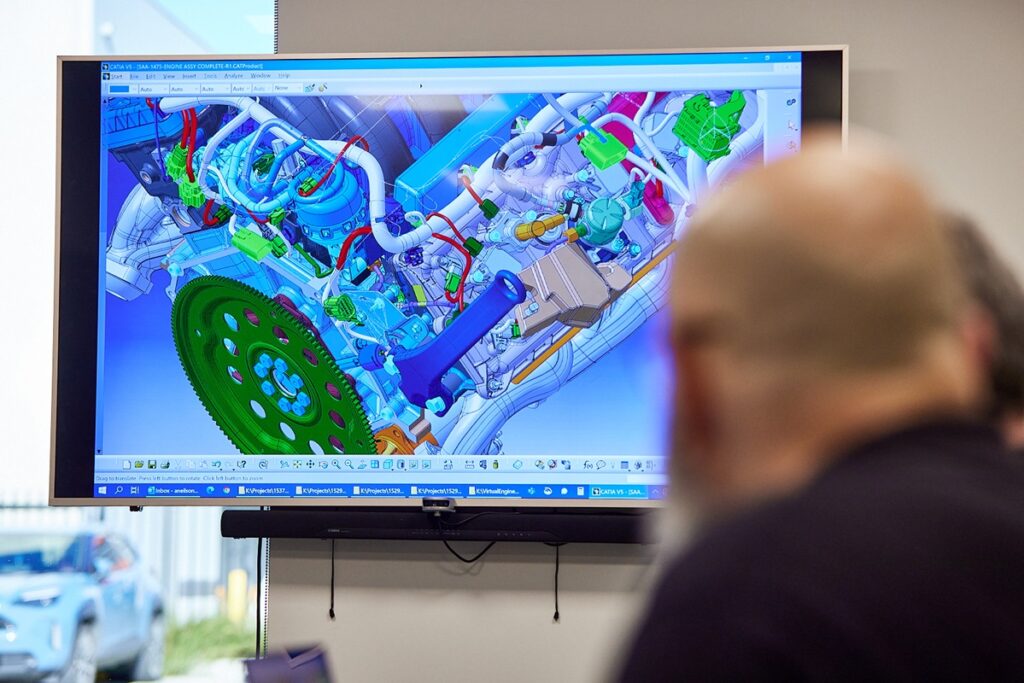

About Premcar – Premcar Pty Ltd is a leading Australian vehicle engineering business that specialises in the automotive, defence and aerospace industries. For more than 25 years, global car-makers have made Premcar their go-to partner for the complete design, engineering and manufacture of niche-model new cars, full-scale new-vehicle development programs, and electric vehicle (EV) conversions and manufacturing. Premcar’s body of work is extensive. It is the name behind more than 200,000 new cars and 55,000 new-vehicle engines. The company has delivered technical advancements and sales success for major car brands from Europe, the USA, Japan, China and Australia. Visit premcar.au.

Follow Premcar on Instagram – @premcaraustralia

Follow Premcar on LinkedIn – @Premcar Pty Ltd